Stock & Mutual Funds

Appreciated securities are powerful tools with profound impact

Donating publicly traded securities, such as stock, bonds or mutual funds, directly to ministry or the Great Commission Donor Advised Fund can provide significant tax savings, allowing you to give more towards the causes you care about.

By donating appreciated shares you have held for at least one year, you avoid the capital gains tax due on the gain. And if you are eligible to claim the donation as an income tax deduction, it would be for the full fair market value of the shares. And, through the projects you support, you’re helping accelerate the Great Commission, so it’s a triple win!

How It Works

Turn tax dollars — like income and capital gains taxes — into dollars with eternal impact.

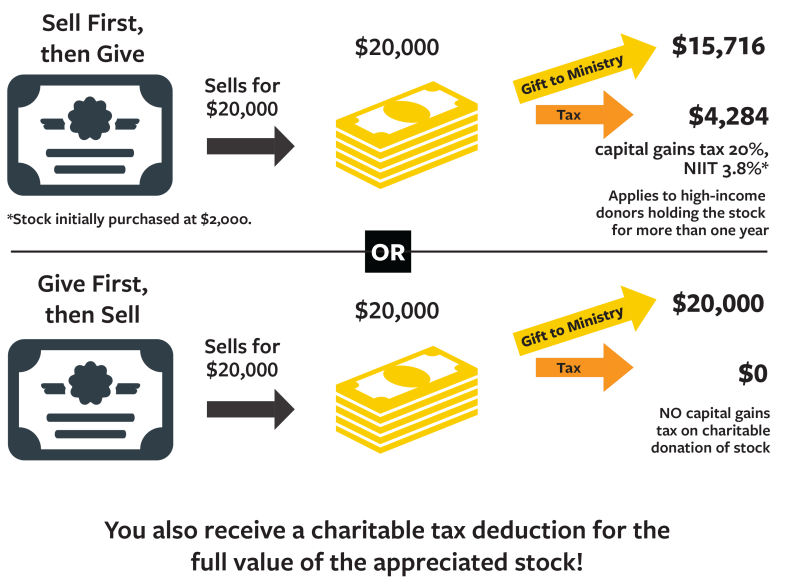

It is very common to approach charitable giving from stock or other assets in a straightforward fashion: sell, then give.

But as generous as that impulse is, the sell-then-give strategy actually becomes the sell-then-pay-taxes-then-give strategy … and that bit in the middle means less funding for ministry.

But when you give-then-sell, capital gains tax dollars are redirected to ministry and the full value of the appreciated stock is tax deductible for eligible taxpayers!

Capital gains tax dollars are redirected to ministry and the full value of the appreciated stock is tax deductible for eligible taxpayers!

Contact us today — we are happy to help and answer your questions!

FAQs

We accept publicly-traded stocks, bonds, and mutual funds. These can be held in an account at a brokerage firm, in physical certificate form, or that were purchased directly from the issuer. Preferred stock may also be given depending on the terms. Please contact us for more details.

This means securities that are worth more than you paid for them and would result in a taxable gain if you sold them. In most cases, it is best to donate securities that have been held for at least 1 year.

This is a great question. If you have a choice between giving cash or highly appreciated securities, consider donating the securities and simultaneously purchasing the same number of shares with the cash you would have donated. With this method, you can take advantage of double tax savings and continue owning the same number of shares, with the added benefit of resetting the cost basis in your portfolio — a tax advantage for you should you need to sell the shares. Keep in mind, “wash sale” rules do not apply to donated shares.

Some of my charities are not able to process stock or mutual fund gifts. But I can give those to my Great Commission Donor Advised Fund account and get the tax savings and then be able to give to all of the charities I love.

– A Cru donor couple from Florida

Get Started

For stock transfers directly to Cru:

- Download and complete the Cru Stock Directive and return it to Cru.

- Make the transfer from your brokerage account to Cru. Once the shares are received, Cru sells the shares within three days.

- Receive a tax-deductible receipt from Cru for tax purposes and support your favorite ministry or the work of missionaries!

For stock transfers into the Great Commission Donor Advised Fund (GCDAF):

- Download and complete the Cru Foundation Stock Directive and return it to Cru Foundation.

- Make the transfer from your brokerage account to Cru Foundation. Once the shares are received, Cru Foundation sells the shares within three days.

- Receive a tax-deductible receipt from Cru Foundation for tax purposes and then from your online account, advise grants to the ministries and charities you love.

→ Because brokerage firms usually do not transmit donor information or the purpose of the gift to us, please make sure to notify Cru or Cru Foundation of your gift and designation.