Investing for Ultimate Impact

Whether you’re passionate about more support for your local church, opportunities for people to hear the gospel, clean water, homes for orphans or all of the above, you can select an investment profile that generates fund growth to support your favorite charities and organizations. We are here to help answer your questions and guide you through making the best decisions to achieve your goals.

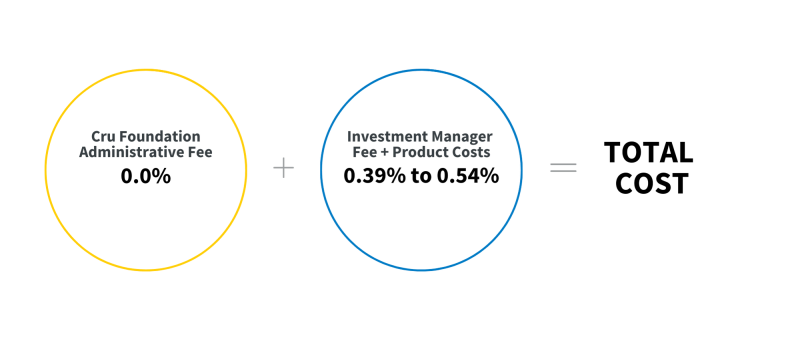

| Asset Allocation Profile | Fee |

| Ultra-Conservative | 0.58% |

| Conservative | 0.43% |

| Moderate Conservative | 0.44% |

| Moderate | 0.45% | Growth | 0.46% | Aggressive | 0.47% |

| Asset Allocation Profile | Fee |

| Ultra-Conservative | 0.58% |

| Conservative | 0.43% |

| Moderate Conservative | 0.44% |

| Moderate | 0.45% | Growth | 0.46% | Aggressive | 0.47% |

Investment Profiles

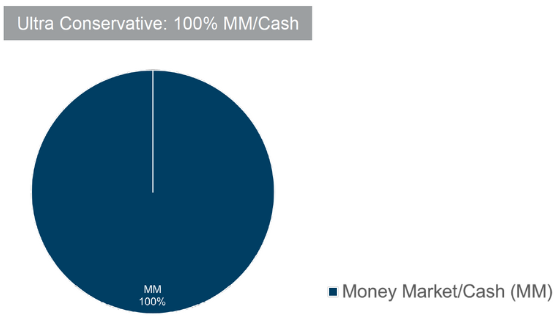

100% Cash and Equivalents.

The Ultra Conservative Profile is invested in a money market mutual fund. This profile seeks the preservation of principal while generating a level of interest greater than that of a bank account. This profile is highly liquid and would be appropriate for investors with a time horizon of less than one year. The Ultra Conservative Profile is subject to a small amount of interest rate risk but does not contain credit or equity (stock) risk.

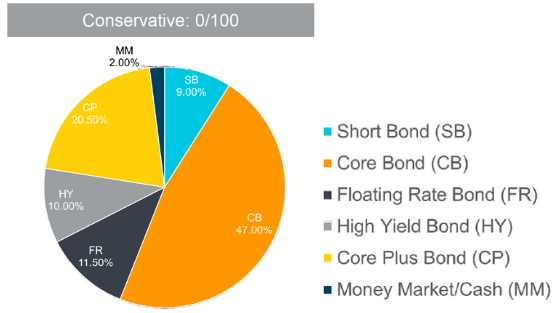

0% Equity / 100% Fixed Income.The Conservative Profile is invested in fixed income and cash securities. This profile seeks preservation of principal, but over long periods of time is expected to generate a higher return than would the Ultra Conservative Profile. The Conservative Profile is subject to interest rate risk and credit risk but does not contain equity (stock) risk.

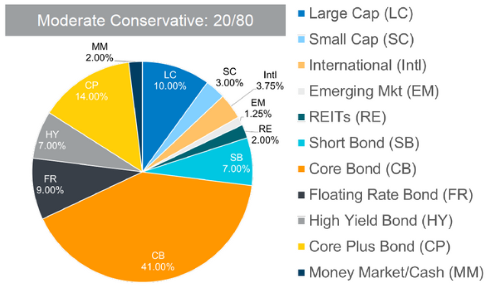

20% Equity / 80% Fixed Income.

The Moderate Conservative Profile blends equity and fixed income securities but primarily utilizes fixed income. This investment profile is subject to low overall volatility but does include some equity (stock) risk. It should be used for funds where some degree of equity exposure is warranted but a lower risk profile is still desired. The recommended time horizon is two to five years. Over long periods of time, the Moderate Conservative Profile is expected to generate higher returns than would the Conservative Profile.

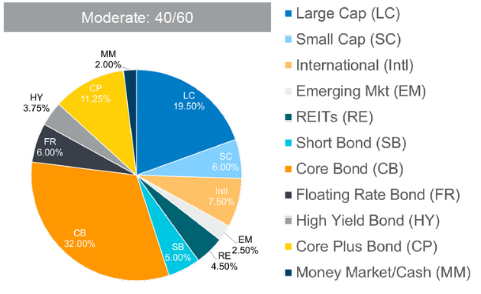

40% Equity / 60% Fixed Income.

The Moderate Profile blends equity and fixed income securities and is oriented more toward fixed income. This profile will exhibit a moderate degree of volatility in principal value and should be used for funds where both growth and some control in volatility are goals. The recommended time horizon is several years or longer. Over long periods of time, the Moderate Profile is expected to generate higher returns than would the Moderate Conservative Profile.

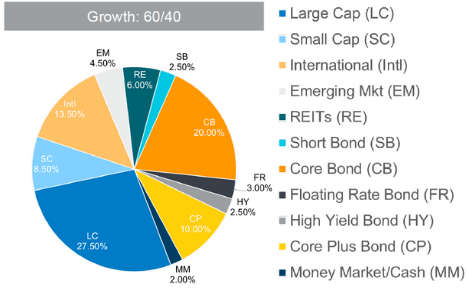

60% Equity / 40% Fixed Income.

The Growth Profile also blends equity and fixed income securities but is oriented more toward equities. This investment profile is subject to moderately high volatility and is suitable for funds with a growth objective. The Growth Profile should be used for funds that have a time horizon of at least five to ten years, such as endowment-like funds. Over long periods of time, the Growth Profile is expected to generate higher returns than would the Moderate Profile.

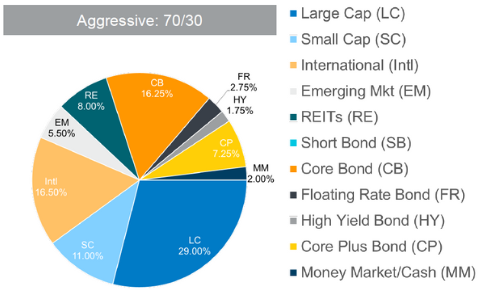

70% Equity / 30% Fixed Income

The Aggressive Profile blends equity and fixed income securities but is equity-oriented. This profile will exhibit a high degree of volatility in principal value and should be used for funds with a growth objective and long time horizon. Over long periods of time, the Aggressive Profile is expected to generate the highest returns and volatility among the investment profiles. The profile should be selected only by donors who are the most able and willing to accept high levels of volatility with the DAF assets.

*All investments are subject to risk. No investment approach ensures growth or prevents loss, especially in a declining market. Cru Foundation has absolute discretion as to the investment of the assets of the fund and shall not be required to consult with either the Advisor(s) or any of the designated charities, as to such investment. Cru Foundation makes no representations or warranties as to the performance of its investment of the assets and is under no obligation to achieve a particular return on investment.