Charitable Remainder Trust

Great benefits now, amazing future gift for ministry.

The Charitable Remainder Trust is a financial tool that makes payments, either a fixed amount (annuity trust) or a percentage of trust principal (unitrust), to whomever you choose to receive the income. All charitable trusts are similar in structure but unique in purpose. Determining your “why?” before implementing the “how” is most important. Cru Foundation can help.

In certain situations, Cru Foundation can serve as trustee, direct the investment of the trust assets, and oversee all legal, accounting and administrative matters, at no additional cost to you. At the end of the trust term, your charitable gift is used to fund the Cru ministry or missionary work you designate, leaving a legacy in the kingdom of God.

Evaluate Your Goals

A charitable remainder trust should be seriously considered when your specific goals include:

Avoiding the capital gains taxes associated with the sale of an asset.

Converting low-income-producing assets into a larger lifetime income stream.

Moving an asset (discounted) and the associated income to another generation.

Partial gifts of an undivided interest in which the charitable tax deduction

from the gift portion will offset a major portion of the taxes on the sale of

the retained portion.

Providing a significant gift to Cru or your other favorite charities.

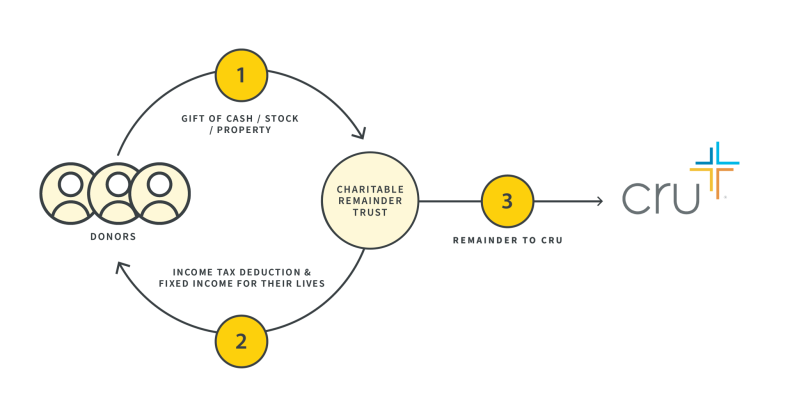

How it works

To get started, we will guide you through determining your gift objectives. Once you’ve decided on a Charitable Remainder Trust, here is an overview of how it works:

Transfer property or undivided interest in a portion of the property to the trust.

Receive an immediate income tax charitable deduction and an income for the lifetime(s) of the income beneficiary(ies).

After the obligations of the trust to the income beneficiaries are fulfilled, the remaining principal will be distributed to your designated Cru ministry or missionary.

Trustee converts the assets to cash and reinvests proceeds to pay an annual income for the lifetime(s) of the income beneficiary(ies).

After the obligations of the trust to the income beneficiaries are fulfilled, the remaining principal will be distributed to your designated Cru ministry or missionary.

Determine financial, estate and gift objectives and an attorney drafts the trust(s).

Transfer property or undivided interest in a portion of the property to the trust(s)

Receive an immediate income tax charitable deduction.

Trustee converts the assets to cash and reinvests proceeds to pay an annual income for the lifetime(s) of the income beneficiary(ies).

After the obligations of the trust to the income beneficiaries are fulfilled, the remaining principal will be distributed to your designated Cru ministry or missionary.

Depending on the custodian, they will either send the QCD check directly to Cru, send the check to the IRA account holder but made payable to Cru, or they may provide the IRA account holder with a checkbook with which to make a QCD. Whichever method, please notify Cru of your gift and your desired intentions.

Payment Rates

Payments are fixed for life and can be made to you, your spouse and/or a loved one. The amount of each payment will depend on the age of the person(s) who receives them.

We live in an uncertain world, but with a CGA, there are two things you can count on. Your investment will share the gospel through Cru, AND you will receive regular income at a fixed rate no matter the condition of the stock market. And over Cru Foundation’s 50 years of existence, we have never missed a payment.